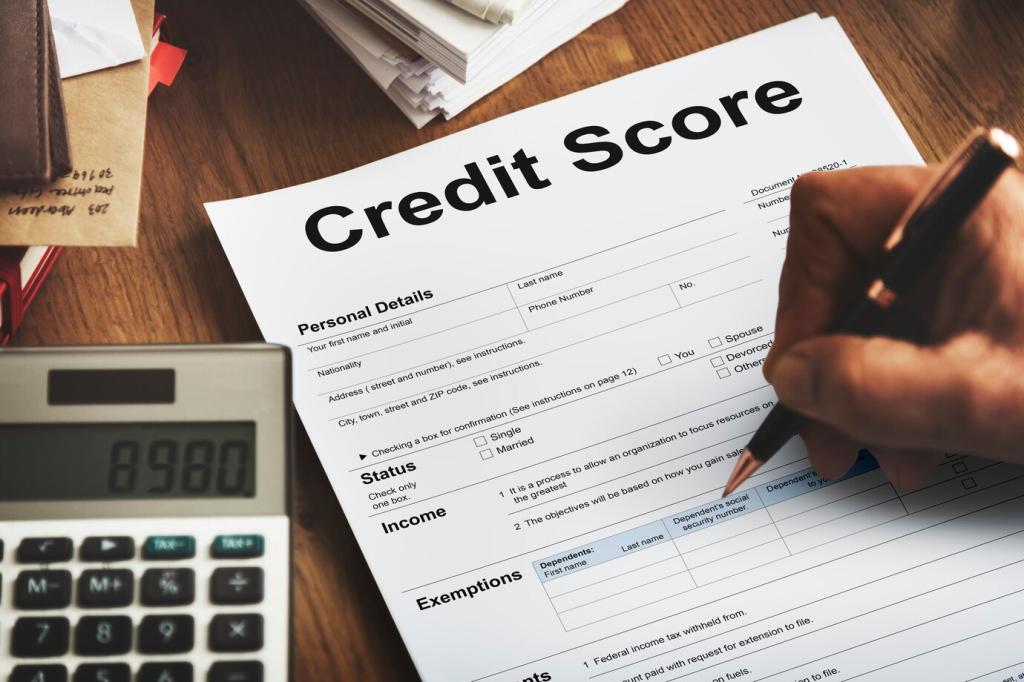

Rates, Fees, and Repayment: Know the True Cost

Fixed rates bring stability; variable rates can start cheaper but move with markets. Amortization spreads principal and interest over time, changing your interest portion monthly. How much payment volatility can your business tolerate comfortably?

Rates, Fees, and Repayment: Know the True Cost

An interest rate alone can hide origination, servicing, draw, or prepayment fees. APR converts the total cost into one comparable number. Always request APR and a repayment schedule. What hidden fee surprised you in past financing?